Trusted by 10k+ Institutions

≡

Trusted by 10k+ Institutions

Blogs

How to get Company Search Report or Company RoC Search Report?

Now a days, Banks are more emphasizing on demanding Company Search Reports from Companies while opening of Bank Accounts or giving the Loan to Companies. The need for Search Reports arises to keep ...

Read More

PUBLISHED : 12-06-2023 12:10:00

How to get The Ministry of Corporate Affairs (MCA) Master Data...

The Ministry of Corporate Affairs (MCA) Registrar of Companies (ROC) office is responsible for overseeing company registration and administration. A facility has been made available to the general ...

Read More

PUBLISHED : 24-05-2023 15:10:00

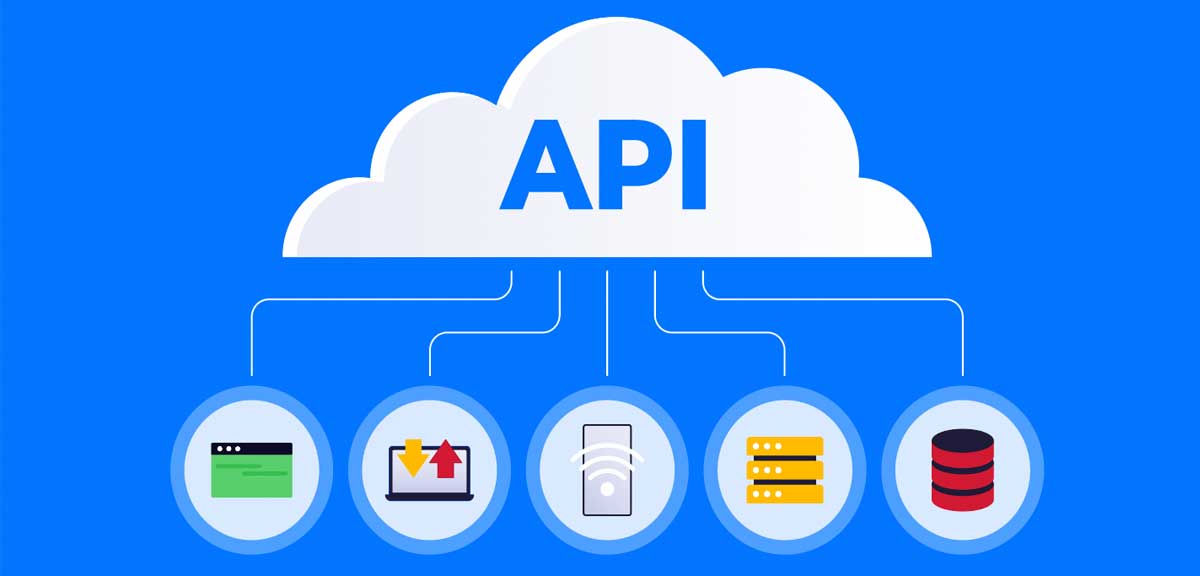

How do APIs work?

APIs, or Application Programming Interfaces, are sets of rules and protocols that allow different software applications to communicate and interact with each other. They define how different softwa...

Read More

PUBLISHED : 19-05-2023 12:25:00

How to increase domain rating?

Domain Rating (DR) is a metric developed by Ahrefs, a popular SEO tool, to measure the authority and strength of a website's backlink profile. Increasing your domain rating involves improving t...

Read More

PUBLISHED : 19-05-2023 13:50:00

What is ITR?

What is ITR?

Income Tax Return (ITR) is a form in which the taxpayers file information about his income earned and tax applicable to the income tax department. The department has notified 7 vario...

Read More

PUBLISHED : 04-11-2020 00:00:00

5 effective ways to arm yourself against online frauds

Avoiding the use of public WiFi, shopping only on known and trusted websites of merchants and entities, avoiding clicking buttons on unknown websites, intimating your bank, insurance company in cas...

Read More

PUBLISHED : 16-09-2020 00:00:00

GST Customer Care

GST Helpline Phone Numbers

By far the most popular way to get in touch with various authorities related to GST is over the phone. You can get help from various relevant government departments ...

Read More

PUBLISHED : 05-08-2020 00:00:00

Difference between Form 16 and Form 16A

The due date to issue Form 16 for the FY 2019-20 is 15 August 2020. Also, the due date to issue Form 16A for Q4 of FY 2019-20 is 15 August 2020.

1. What is Form 16?

Form 16 is your salary T...

Read More

PUBLISHED : 08-07-2020 00:00:00

Impact of GST on Water based products

NIL GST Water and Water-based Products

The following products classified as water/water-based products feature nil GST rate:

Water excluding aerated, mineral, purified, disti...

Read More

PUBLISHED : 02-07-2020 00:00:00

GST on Cars

Goods and Services Tax (GST) currently applies to most goods and services in India including motor vehicles. GST on cars in India is applicable across multiple slab rates of 5%, 12%, 18% and 28%. T...

Read More

PUBLISHED : 26-06-2020 00:00:00

Impact of GST on Gold

Gold especially gold ornaments are one of the very few items that feature GST applicability multiple times and that too at different rates. GST on gold as a good is 3%, while in case of gold jewelr...

Read More

PUBLISHED : 16-06-2020 00:00:00

GST on Food

Goods and Services Tax on food services in India can be 5%, 12% or 18% depending on a variety of factors including but not limited to type of establishment and location of restaurant/food serv...

Read More

PUBLISHED : 12-05-2020 00:00:00

GST Rates 2020-21, Complete List of Goods and Services Tax Slabs

GST is perhaps the biggest tax-related reform in India since Independence bringing uniformity in the taxation structure and eliminating the cascading of taxes that was levied in the past. The GST C...

Read More

PUBLISHED : 09-05-2020 00:00:00

Frequently Asked Questions (FAQs) on GST

Q1. What are the different GST rates on goods?

Ans. Currently five different GST rates are applicable on goods. These are 0.25% (e.g. cut and semi-polished stones), 5% (e.g. household nec...

Read More

PUBLISHED : 02-05-2020 00:00:00

GST on Real Estate

At the 33rd GST Council Meeting held on 24th February 2019, new GST rates have been introduced for residential real estate which will come into effect from the 1st of April 2019. The...

Read More

PUBLISHED : 17-04-2020 00:00:00

GST rates applicable on Medicines and Medical Supplies

After introduction of GST on pharmaceuticals and medical supplies in India are taxed at four separate rates of Nil, 5%, 12% and 18%. The nil GST on medicines is currently only applicable to human b...

Read More

PUBLISHED : 13-04-2020 00:00:00

Everything you need to know about MSME Udyam Registration

The idea behind introducing Udyam Registration was to simplify the procedural format that business owners had to go through to register their business under Micro Small Medium Enterprise or MSME.

...

Read More

PUBLISHED : 03-01-2020 00:00:00

Advantages and Benefits of using ChatBot for your business

A chatbot is an artificial intelligence (AI) software that can simulate a conversation (or a chat) with a user in natural language through messaging applications, websites, mo...

Read More

PUBLISHED : 09-09-2019 00:00:00

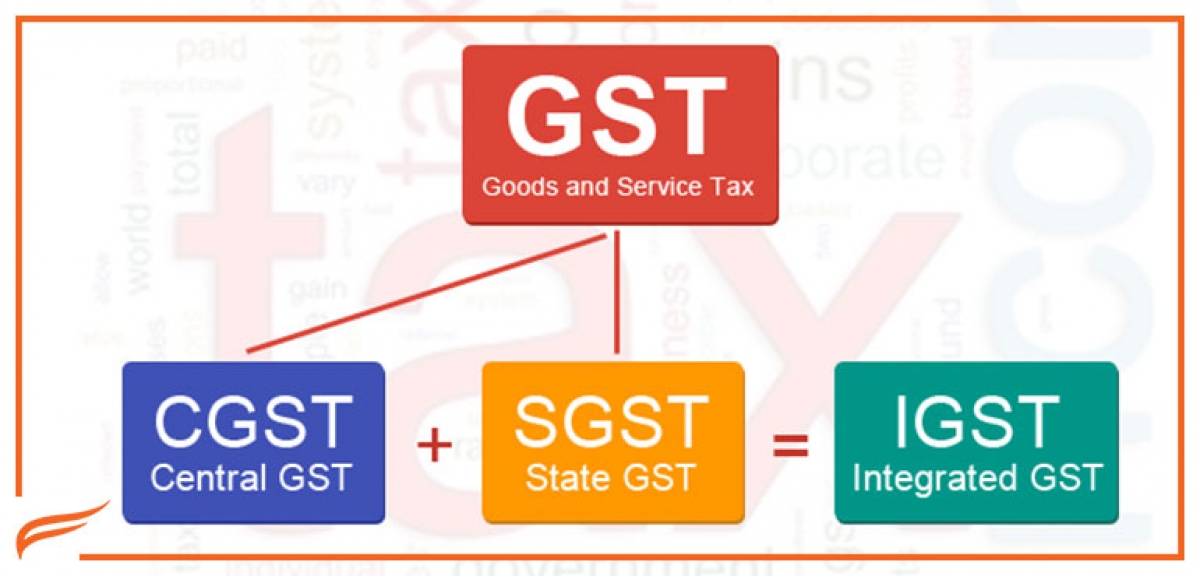

Goods and Services Tax (GST)

Goods and Services Tax (GST) can be rightfully called as the largest Indirect Taxation Reform of the country since 1947. The history of GST in India goes back to 2006 when the Finance Min...

Read More

PUBLISHED : 11-04-2019 00:00:00

Types of GST, What is SGST, CGST & IGST?

Goods and Services Tax (GST) is single comprehensive tax applicable for the entire nation. It has replaced a number of indirect taxes in India, including central excise duty, state V...

Read More

PUBLISHED : 13-02-2019 00:00:00

Professional Tax: All You Need to Know

When you take a look at your payslips, you will notice a small deduction mentioned on it, along with the other components like HRA, conveyance and basic salary break ups. This deduction is usually ...

Read More

PUBLISHED : 03-05-2017 00:00:00